Adco ready to sign Bab expansion contract

25 October, 2017 | By Wil Crisp

The state-backed Abu Dhabi Company for Onshore Petroleum Operations (Adco) is ready to sign the contract for the Bab Integrated Facilities Project Expansion, one of the largest planned oil and gas projects in the UAE.

“Negotiations have finished and the deal has been finalised,” said a source.

“Adco is now just looking for the right opportunity to formally announce the project award and sign the contract.”

Adco is likely to choose the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) 2017, which is due to take place on 13-16 November, in order to announce the contract, according to the source.

The engineering procurement and construction (EPC) contract for the Bab Integrated Facilities Project Expansion project is estimated to be worth around $1.7bn.

Revised bids for the EPC contract were submitted on 10 September after a series of deadline extensions.

Earlier companies were asked to submit bids by 18 June. This was subsequently extended to 8 August – when bids were submitted by companies.

Then Adco asked companies to submit a new set of revised bids by 10 September.

MEED understands that the companies which submitted bids are:

- SK Engineering & Construction (South Korea) / Intecsa (Spain)

- Tecnicas Reunidas (Spain)

- Saipem (Italy)

- JGC (Japan) / National Petroleum Construction Company (UAE)

- China Petroleum Engineering & Construction Corporation (China)

- Petrofac (UK)

China Petroleum Engineering & Construction Corporation (CPECC), which is affiliated with the state-owned China National Petroleum Corporation (CNPC), submitted the lowest bid for the contract and is the favourite to win the contract according to industry sources.

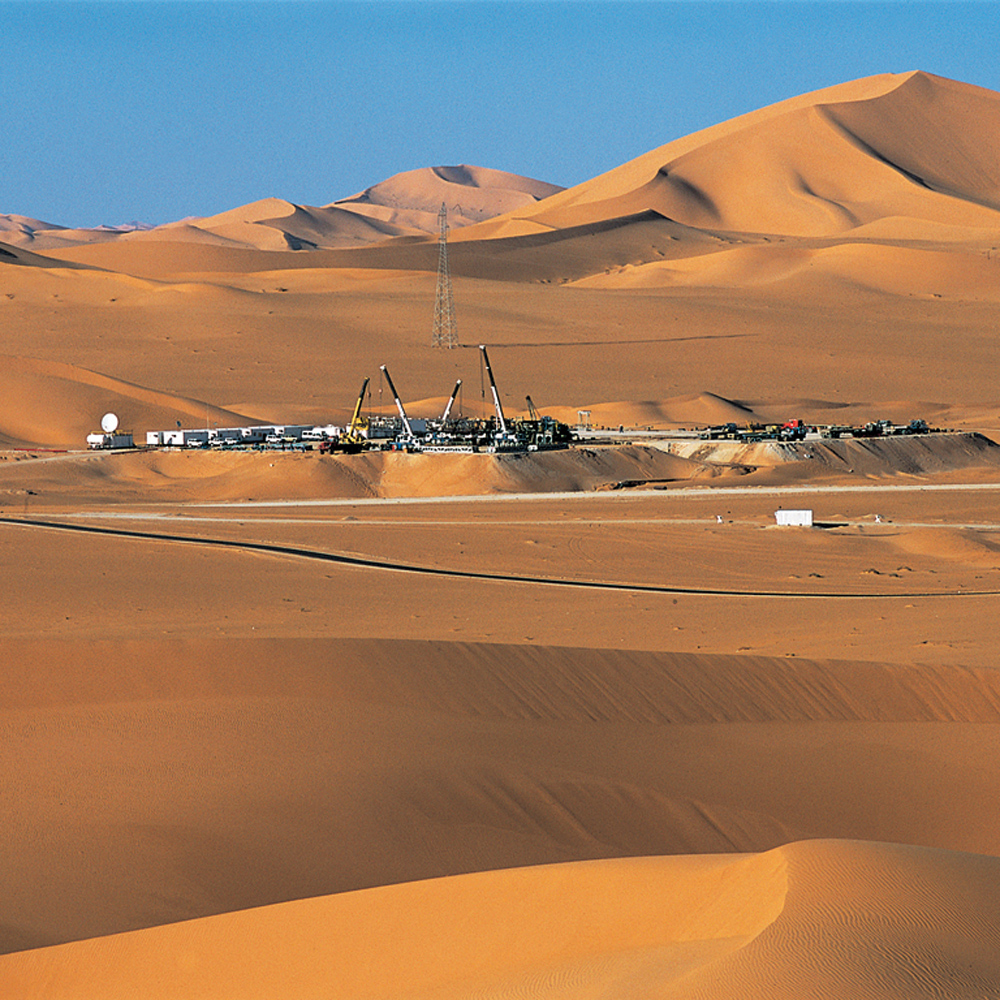

The scope of work involves installing new facilities at Adco’s Bab field, located 160 kilometres southwest of Abu Dhabi city.

As part of the original scope, surface facilities would be delivered for the Thamama-A, Thamama-H and Thamama-B production zones to achieve a total sustainable oil production rate of 450,000 barrels a day (b/d).

Adco re-tendered the Bab integrated facilities expansion scheme on 22 December, a year after cancelling a previous tender on the project.

The re-tendered version of the project had a reduced scope of works and the estimated budget was reduced from $3bn to about $2bn.

Adco is a joint venture of Abu Dhabi National Oil Company (Adnoc) and six international oil firms.

Related Posts

CEO of the UAE's ASGC says construction is experiencing demand losses on four levels

The construction sector is witnessing demand evaporation on four levels that will impact the industry in the ...

READ MORE

With the political will to use the public-private partnership model and the bureaucratic infrastructure in place, the outlook for PPPs is positive in the UAE

Outside the power and water sectors, ...

READ MORE

Dubai and Abu Dhabi are taking leading roles as countries start to emerge from lockdowns

The second half of 2020 will be crucial for the global economy as countries begin to ...

READ MORE

The partnership will explore growth opportunities in the retail sector across the GCC region

Dubai-based Meraas Holding has entered into a AED5bn ($1.4bn) strategic partnership with Canada’s Brookfield Asset Management to ...

READ MORE

The combined value of all projects planned or under way in the five North African countries is about $739bn

The signing on 11 December 2017 of an agreement between Egypt and Russia ...

READ MORE

UKEF has capacity to fund £9bn of schemes in the UAE and £4.5bn in Saudi Arabia

The growing interest from project clients for using export credit facilities to fund their projects ...

READ MORE

By seeking expressions of interest for an estimated $4bn project, Borouge has helped to boost the market

Borouge, the 60:40 joint venture (JV) of Abu Dhabi National Oil Company (Adnoc) and Austria’s ...

READ MORE

Given the dramatic transformations happening in the healthcare sector, clinical laboratories are undergoing similar changes, too. Specialised diagnostic services are growing as the global focus of public health is on ...

READ MORE

Despite initial optimism for 2018, the GCC recorded its worst year in terms of new contract awards since 2004, but 2019 is looking more positive

Rising oil prices, bullish government announcements ...

READ MORE

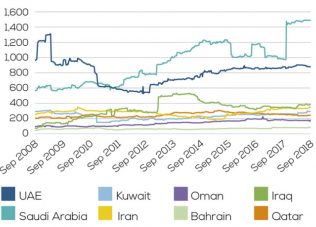

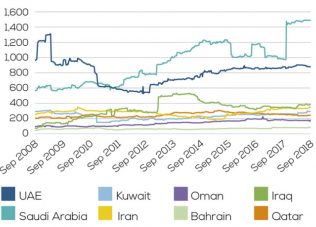

Saudi Arabia and the UAE each shed 0.1 per cent during the week of 8-14 September 2018

Data shows value of projects planned or under way ($bn)

Led by Oman, country indices ...

READ MORE

Covid-19 slashes contracting demand

PPPs expected to take off in UAE

UAE leads as global economy restarts

Meraas forms strategic partnership with Canada’s Brookfield

North Africa is a challenging market with huge

UK to support export credit deals with dedicated

Abu Dhabi bolsters regional petrochemicals market

Rising demand of specialised laboratory diagnostics services in

Dashed hopes give way to cautious optimism

Smaller markets lead Gulf index growth

25 October, 2017 | .By Wil Crisp