A new approach to large financings

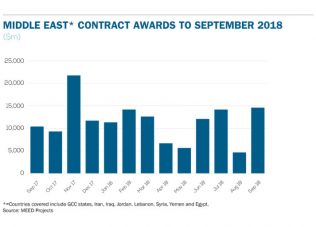

With oil prices starting to firm, lenders from within the region and beyond are coming under pressure to close a looming funding gap facing major projects. In the GCC alone, ratings agency Standard & Poor’s estimates the difference between the value of projects to be awarded by the end of 2019 and the capital expenditure that governments have committed at $270bn.

This has left banks straining to commit the levels of project finance required by major infrastructure and other related schemes in order to get off the ground. Though the appetite of lenders for longer-tenor deals is showing signs of reviving to pre-low oil price levels, there are challenges in matching supply with demand.

One of these is the damage wrought to loan books by the slowdown in economic activity. Non-performing loan (NPL) levels have risen, with the ratio of NPLs to total loans in the GCC reaching a rate of 3.1 per cent at the end of September 2017, up from 2.9 per cent at year-end 2016, according to Moody’s Investors Service.

And Moody’s expects NPL ratios to continue to deteriorate over the next six months before progressively stabilising. That could deter some banks from participating in project financings, though the space afforded to certain banks to root out the problematic parts of their credit portfolios should ultimately leave them in a stronger position to lend to long-tenor project-related deals.

A selective approach

One effect of the tighter liquidity conditions seen in the region – which in part reflects governments’ policies of withdrawing deposits from the local banking sector during periods of lower oil revenues – is that lenders are being more selective in which projects they choose to support.

“In a deteriorating environment, there is less capacity to lend money to projects that can be seen as a bit risky,” says Arnaud Depierrefeu, a partner at law firm Simmons & Simmons’ Doha practice. “Banks are starting to understand that they will have to lower their expectations in terms of government support going forward.”

The result is that the project finance market has found itself squeezed. The increasing selectiveness of the banks has led to the market increasingly seeing risk-sharing agreements in which guarantees are provided by governments and sponsors. Another trend is to push more risk onto the international sponsors. Other deals that have lacked large sponsors have struggled in the marketplace.

This challenges the traditional project finance model, says Depierrefeu, which by its nature was intended to be non-recourse for sponsors, who are now asked to provide guarantees instead.

Bank appetites for Middle East and North Africa (Mena) region project financing can vary widely, says Bimal Desai, a partner at Allen & Overy’s Dubai practice, who has experience in structured financings in the Middle East. “The willingness to lend is often driven by relationships with sponsors, but some banks are simply out of project finance.”

Export credit agencies

There does appear to be more ability to write local tickets in the market among local lenders. What has helped this is the re-emergence of export credit agencies (ECAs) in Mena region project financings.

“The ECAs are front and centre again in project finance deals,” says Desai. “In the old days, you could not do anything without them, but from the mid-2000s, you could do a lot without them. Now we are back full circle: you cannot do bigger deals without the ECAs these days.”

As an example, take the financial close for a 250MW wind independent power project in Ras Ghareb in Egypt’s Gulf of Suez that was reached in December 2017 by a consortium led by France’s Engie.

Non-recourse project financing was provided by the Japan Bank for International Corporation in coordination with Sumitomo Mitsui Banking Corporation and Societe Generale under a Nippon Export and Investment Insurance cover. This sat alongside an Egyptian component, with the Commercial International Bank Egypt acting as working capital bank and Attijariwafa Bank providing an equity bridge loan.

This deal also highlights the growing Asian presence in the region’s project finance market. Desai adds: “The other thing is that the liquidity coming from the Chinese banks has growing potential. They are big players in the power and utilities sector, and will soon start expanding into petrochemicals and oil and gas as well.”

Another Mena-wide project finance trend is the increasing receptiveness towards capital market structures within the funding mix. This is especially evident in the refinancing market. In the UAE, Ruwais Power Company’s Shuweihat S2 independent water and power project (IWPP) was partially refinanced in August 2013 through an $825m bond that will mature after 16–18 years.

In November 2017, Emirates Sembcorp Water & Power Company raised $400m with a senior secured bond to fund the operation and maintenance of the Fujairah 1 IWPP in the UAE.

A couple more such deals are currently being talked about, but while the power refinancing market is active, greenfield capital market project financing is still some way off.

With stronger balance sheets beckoning, local lenders’ capacity to commit to the region’s funding gap should increase. But the trend is clear: the bigger deals, with larger sponsors and that also take in ECAs, are likely to be the ones that prosper.