Gulf states to spend $320bn in the oil and gas sector

27 February, 2018 | By WIL CRISP

Gulf states are planning to spend $320bn in the oil and gas sector, according to Suhail Mohamed al-Mazrouei, the UAE’s Minister of Energy & Industry and the current Opec Conference President.

Saudi Arabia, Kuwait and the UAE are each planning to invest $100bn, according to Al-Mazrouei.

The UAE energy minister said he believed the US was also seeing a high level of investment, speaking at the International Petroleum Week conference in London.

“We need more investment,” he said.

Al-Mazrouei said that if there was not enough investment on production there could be future price volatility in energy markets.

He said that there was a risk that “when a shock comes we won’t have enough supply to meet demand,” and a buffer of spare production capacity is needed to prevent future boom and bust cycles.

Global investment in oil and gas during 2017 lagged behind levels recorded in 2015 and 2016.

Related Posts

Partnership will grow to accommodate developments in sectors such as construction and energy

MEED and Mashreq have announced the extension of their knowledge partnership for a third year.

First established in 2017, ...

READ MORE

Major petrochemicals producers have been making considerable capital investments in setting up derivatives complexes

The Middle East and North Africa (Mena) region is set to witness a gathering of pace in ...

READ MORE

Prevailing energy analysis has focused heavily on US shale oil production and US oil storage, but perhaps at the cost of keeping an eye on the big picture

Since the start ...

READ MORE

A series of events in the final weeks of 2017 provide a strong indication of what we can expect in the year ahead.

From an economic perspective, the most significant was ...

READ MORE

The UAE's offer to repatriate expatriates has not been taken up by India

Discussions are under way to repatriate foreign workers, including Indian and Pakistani nationals, from the UAE as the ...

READ MORE

Saudi Arabia will need to convince its fellow Opec and non-Opec members, in particular Russia, to deepen oil production cuts to salvage crude prices

Deepening the existing oil production cut agreement is no ...

READ MORE

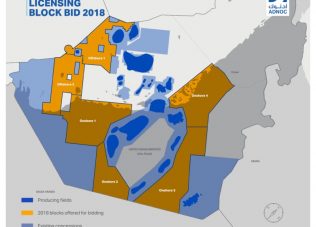

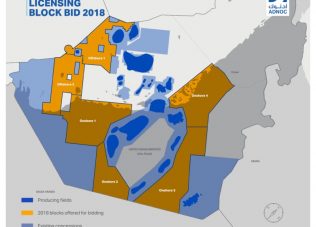

State oil giant Adnoc announces details of four onshore and two offshore blocks in which it will hold majority 60 per cent stake

The Abu Dhabi National Oil Company (Adnoc) has ...

READ MORE

Stock listing of assets is becoming a preferred fundraising method for Abu Dhabi

While Riyadh continues to work out its listing of Saudi Aramco, Abu Dhabi is moving ahead with more initial public ...

READ MORE

Scope of work includes building platforms and pipelines at offshore sour gas field in Abu Dhabi

Adnoc Sour Gas – the sour gas unit of the Abu Dhabi National Oil Company ...

READ MORE

Ratings agency Moody’s says oil and gas discovery should attract foreign investment into the kingdom

The discovery of hydrocarbon deposits in Bahrain – if verified by an international oil consortium as ...

READ MORE

MEED and Mashreq renew partnership for third year

Petrochemicals sector poised for expansion

The risk of US shale hype in global

States deliberate on stranded South Asian workers

Output cut becomes imperative for oil producers

Abu Dhabi offers six oil and gas blocks

Abu Dhabi seeking IPO rewards

EXCLUSIVE: Adnoc expected to seek contractors for Dalma

Bahrain upstream discovery could boost credit ratings

27 February, 2018 | .By WIL CRISP