Adco ready to sign Bab expansion contract

25 October, 2017 | By Wil Crisp

The state-backed Abu Dhabi Company for Onshore Petroleum Operations (Adco) is ready to sign the contract for the Bab Integrated Facilities Project Expansion, one of the largest planned oil and gas projects in the UAE.

“Negotiations have finished and the deal has been finalised,” said a source.

“Adco is now just looking for the right opportunity to formally announce the project award and sign the contract.”

Adco is likely to choose the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) 2017, which is due to take place on 13-16 November, in order to announce the contract, according to the source.

The engineering procurement and construction (EPC) contract for the Bab Integrated Facilities Project Expansion project is estimated to be worth around $1.7bn.

Revised bids for the EPC contract were submitted on 10 September after a series of deadline extensions.

Earlier companies were asked to submit bids by 18 June. This was subsequently extended to 8 August – when bids were submitted by companies.

Then Adco asked companies to submit a new set of revised bids by 10 September.

MEED understands that the companies which submitted bids are:

- SK Engineering & Construction (South Korea) / Intecsa (Spain)

- Tecnicas Reunidas (Spain)

- Saipem (Italy)

- JGC (Japan) / National Petroleum Construction Company (UAE)

- China Petroleum Engineering & Construction Corporation (China)

- Petrofac (UK)

China Petroleum Engineering & Construction Corporation (CPECC), which is affiliated with the state-owned China National Petroleum Corporation (CNPC), submitted the lowest bid for the contract and is the favourite to win the contract according to industry sources.

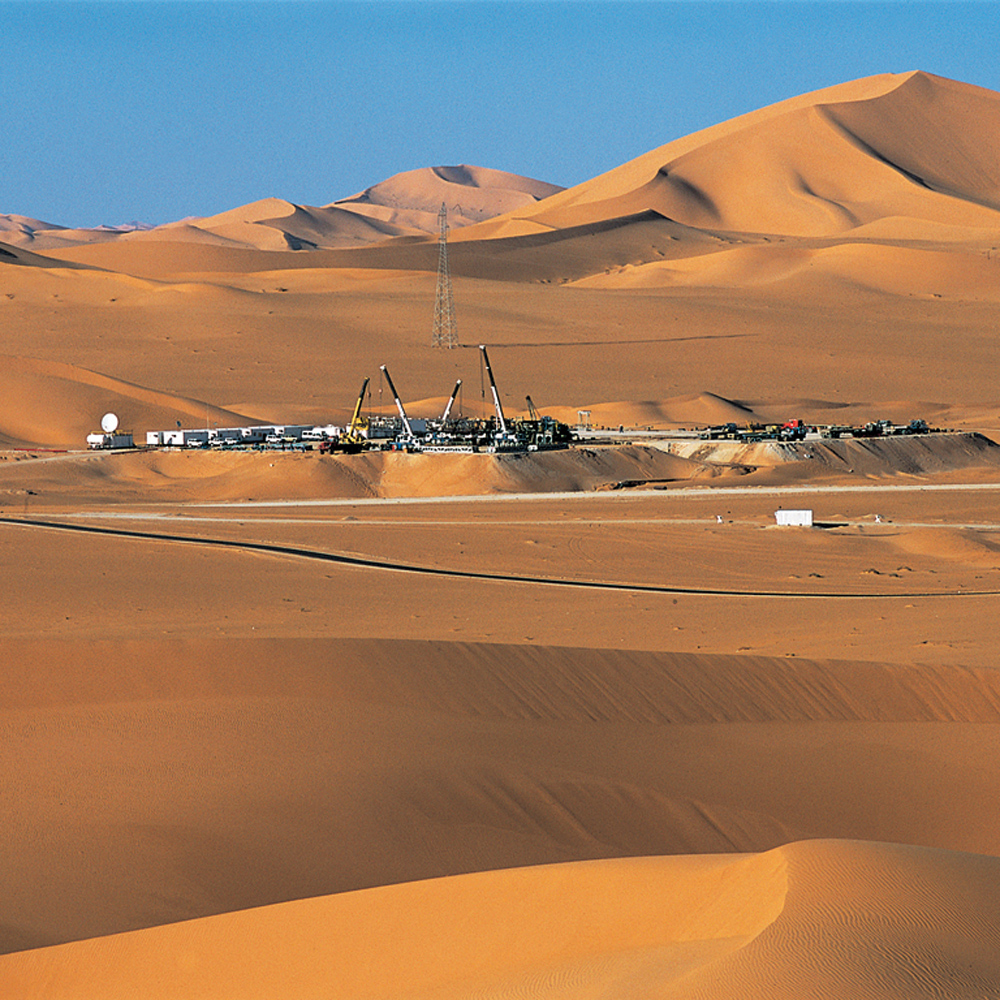

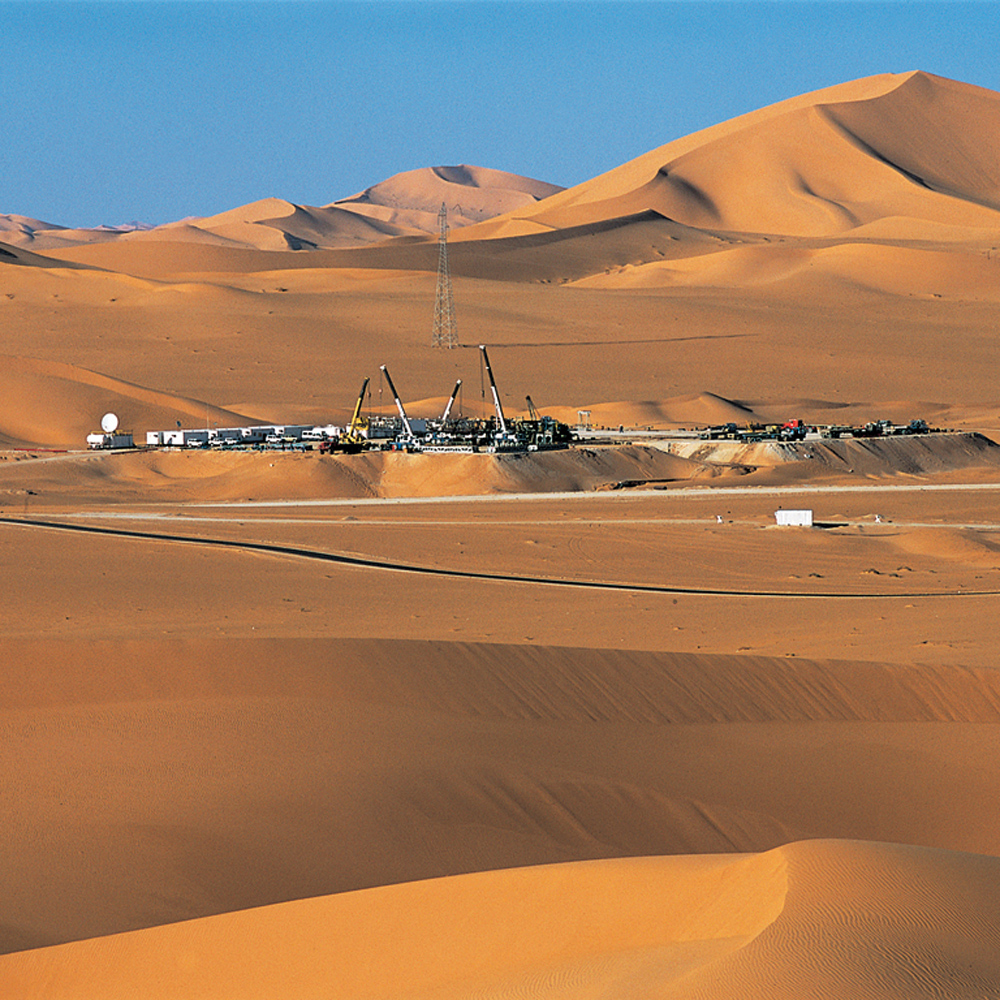

The scope of work involves installing new facilities at Adco’s Bab field, located 160 kilometres southwest of Abu Dhabi city.

As part of the original scope, surface facilities would be delivered for the Thamama-A, Thamama-H and Thamama-B production zones to achieve a total sustainable oil production rate of 450,000 barrels a day (b/d).

Adco re-tendered the Bab integrated facilities expansion scheme on 22 December, a year after cancelling a previous tender on the project.

The re-tendered version of the project had a reduced scope of works and the estimated budget was reduced from $3bn to about $2bn.

Adco is a joint venture of Abu Dhabi National Oil Company (Adnoc) and six international oil firms.

Related Posts

The expansion is due to be completed by the fourth quarter of 2019

Brooge Petroleum & Gas Investment Company (BPGIC) is looking to boost capacity for crude and oil products at ...

READ MORE

State oil company targeting five offshore and three onshore fields for high-sulphur gas capacity expansions

Abu Dhabi National Oil Company (Adnoc) is considering the investment of $20bn in developing sour gas ...

READ MORE

Plunging oil prices triggered a SR34.1bn deficit in Saudi Arabia’s first quarter budget

The region’s largest economy has the most to gain, or lose, depending on how quickly the Covid-19 pandemic is contained ...

READ MORE

State oil producer had already shown signs of a change in partnership strategy

Lower oil prices over the last three years have forced national oil companies (NOCs) in the Middle East ...

READ MORE

China investment makes up an increasing proportion of the financial support for the largest projects in the region’s power sector

The financial close of the $4.4bn fourth phase of Dubai’s Mohammed ...

READ MORE

Mena petrochemicals producers target ambitious growth

Downloadable briefing paper from MEED, in partnership with Mashreq, examines rising capital investments in Mena’s petrochemicals sector

About $33.8bn-worth of petrochemicals projects are under execution in the ...

READ MORE

The privatisation of state oil companies shows the desire to reform outdated economic models is genuine.

The fight between the London and New York stock exchanges to secure the listing of ...

READ MORE

Steps have been taken to get around the region’s gas shortage, but competitive threats remain

The seismic shift in the GCC petrochemicals sector that consultants and analysts have been predicting for more ...

READ MORE

Recent discoveries will make the Abu Dhabi-led drive for gas self-sufficiency a shared endeavour with the emirates of Sharjah and Dubai

With natural gas now firmly established as the global power ...

READ MORE

Oilfield service companies must adapt and innovate to survive in the wake of the Covid-19 pandemic

By 7 June 2020, more than 6.6 million worldwide had tested positive for Covid-19 and ...

READ MORE

UAE midstream firm to expand Fujairah storage facility

Abu Dhabi considering $20bn investment in offshore sour

Saudi Arabia balances economics and safety

Abu Dhabi oil opens up assets to global

China ramps up investment in Middle East power

BRIEFING PAPER: Renewed Ambitions

Oiling the Wheels of the Economy

Petrochemicals industry is starting to evolve

UAE’s gas discoveries bring self-sufficiency goal closer

BRIEFING PAPER: Broadening Horizons

25 October, 2017 | .By Wil Crisp