The evolving GCC capital markets landscape

The UAE continues to lead capital market transformation in the GCC, with IPOs playing a pivotal role in unlocking state value and broadening investor participation.

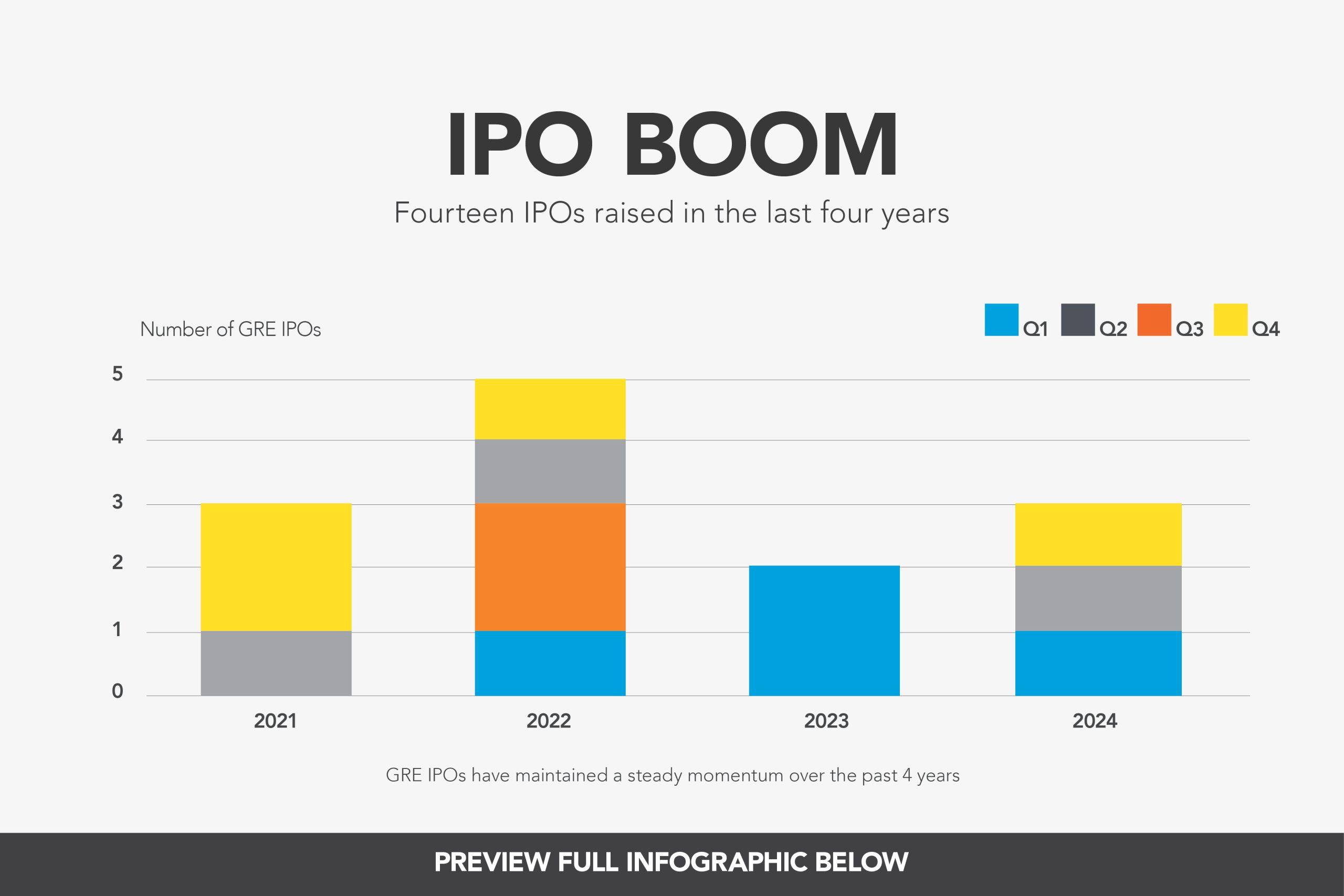

Government-related entities (GREs) have driven much of this momentum, enabling asset monetisation while deepening liquidity and diversifying the investor base. From DEWA’s record $6.1bn listing to ADNOC Gas and Oman’s OQEP, more than $20bn has been raised through 14 IPOs between 2021 and 2024.

These deals not only support fiscal sustainability and infrastructure investment but also reflect a broader strategy to foster market maturity and economic diversification. In parallel, GCC sovereign debt markets surged in 2024, with bond and sukuk issuances reaching $77.2bn—the highest level in four years.

Saudi Arabia and the UAE led issuance volumes, accounting for 80% of the regional total. Financial institutions, sovereigns, and rising sectors such as utilities and real estate are driving issuance trends, pointing to evolving market dynamics. With IPO pipelines expanding and debt instruments gaining traction, the region’s capital markets are entering a new phase of growth and resilience.

Explore the trends shaping GCC capital markets in our latest infographic